The Fintech (Financial Technology) market has experienced unprecedented growth and transformation in recent years, reshaping the landscape of the financial services industry. Fintech encompasses a wide range of innovative technologies and solutions that leverage software and digital platforms to enhance and automate financial services. The market is characterized by dynamic advancements in areas such as mobile payments, blockchain, artificial intelligence, robo-advisors, and peer-to-peer lending. As traditional financial institutions adapt to the digital age, new entrants continue to disrupt the sector, fostering competition and driving innovation.

Get Free Sample Report: -

https://pristineintelligence.com/request-sample/global-fintech-market-36

Updated Version 2023 is available our Sample Report May Includes the:

- Scope For 2023

- Brief Introduction to the research report.

- Table of Contents (Scope covered as a part of the study)

- Top players in the market

- Research framework (structure of the report)

- Research methodology adopted by Worldwide Market Reports

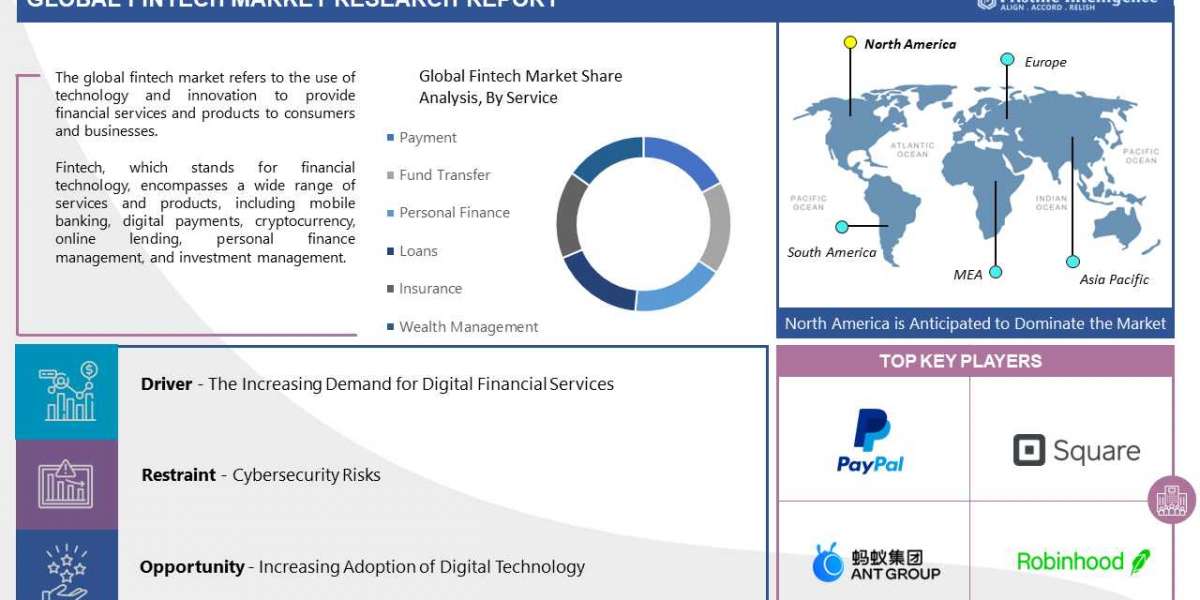

Leading players involved in the Fintech Market include:

"PayPal (U.S.), Square (U.S.), Stripe (U.S.), Ant Group (China), Revolut (UK), TransferWise (UK), Robinhood (U.S.), Adyen (Netherlands), Klarna (Sweden), Nubank (Brazil), Plaid (U.S.), Coinbase (U.S.), SoFi (U.S.), OnDeck (U.S.), Funding Circle (UK), iZettle (Sweden), Wealthfront (U.S.), Acorns (U.S.), Tala (U.S.), Zopa (UK) and Other Major Players."

Market Driver:

One of the key drivers propelling the Fintech market is the increasing consumer demand for convenient, efficient, and personalized financial services. As technology becomes ingrained in daily life, consumers expect seamless and user-friendly experiences in their financial transactions. Fintech companies, often unencumbered by legacy systems, are able to respond quickly to these demands, offering agile solutions that streamline processes, reduce costs, and enhance accessibility. The drive for financial inclusion, especially in emerging markets, further fuels the demand for Fintech solutions, as they provide opportunities to reach underserved populations.

Market Opportunity:

A significant market opportunity lies in the integration of Fintech solutions with emerging technologies, such as blockchain and artificial intelligence. Blockchain, with its decentralized and secure nature, has the potential to revolutionize areas like digital identity verification, cross-border payments, and smart contracts. Meanwhile, artificial intelligence can power advanced analytics, fraud detection, and personalized financial advice. Fintech companies that strategically leverage these technologies stand to create innovative, differentiated offerings that cater to evolving market needs. Additionally, the growing trend of sustainable finance and ESG (Environmental, Social, Governance) considerations presents an opportunity for Fintech firms to develop solutions that align with responsible and ethical financial practices.

Unlock a treasure trove of market insights this Black Friday! Enjoy a spine-tingling 30% off on our comprehensive market reports. Hurry, this offer won’t haunt you forever.

Get discount on premium Market Report, Visit:

https://pristineintelligence.com/discount/global-fintech-market-36

Segmentation of Fintech Market:

By Service

- Payment

- Fund Transfer

- Personal Finance

- Loans

- Insurance

- Wealth Management

By Application

- Banking

- Insurance

- Securities

- Others

By Deployment Mode

- Cloud

- On-Premises

An in-depth study of the Fintech industry for the years 2023–2030 is provided in the latest research. North America, Europe, Asia-Pacific, South America, the Middle East, and Africa are only some of the regions included in the report's segmented and regional analyses. The research also includes key insights including market trends and potential opportunities based on these major insights. All these quantitative data, such as market size and revenue forecasts, and qualitative data, such as customers' values, needs, and buying inclinations, are integral parts of any thorough market analysis.

Market Segment by Regions: -

- North America (US, Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

- Middle East Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Reasons to Purchase this Market Report:

- Market forecast analysis through recent trends and SWOT analysis

- Fintech Market Dynamics Scenarios with Market Growth Opportunities over the Next Year

- Market segmentation analysis, including qualitative and quantitative studies that include economic and non-economic impacts

- Fintech Market Regional and country-level analysis that integrates demand and supply forces that impact the growth of the market.

- Competitive environment related to the Fintech market share for key players, along with new projects and strategies that players have adopted over the past five years

Purchase This Reports: -

https://pristineintelligence.com/buy-now/36

About Us:

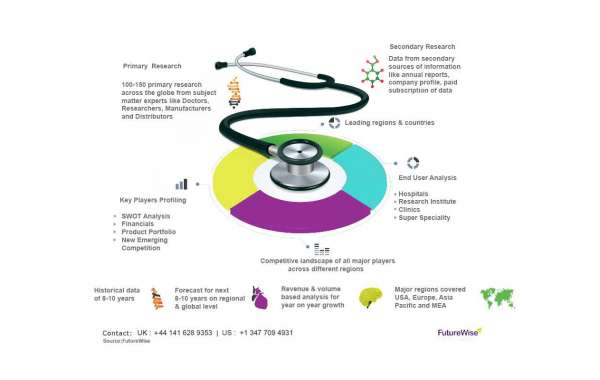

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367