Credit cards have become an integral part of modern financial life, offering numerous advantages to consumers beyond just convenient payment methods. This comprehensive guide explores the multifaceted benefits of credit cards, shedding light on how they can be valuable financial tools when used responsibly. From building credit and earning rewards to enhancing security and providing financ ial flexibility, credit cards offer a wide array of advantages that can positively impact your financial well-being.

1. Building and Improving Credit

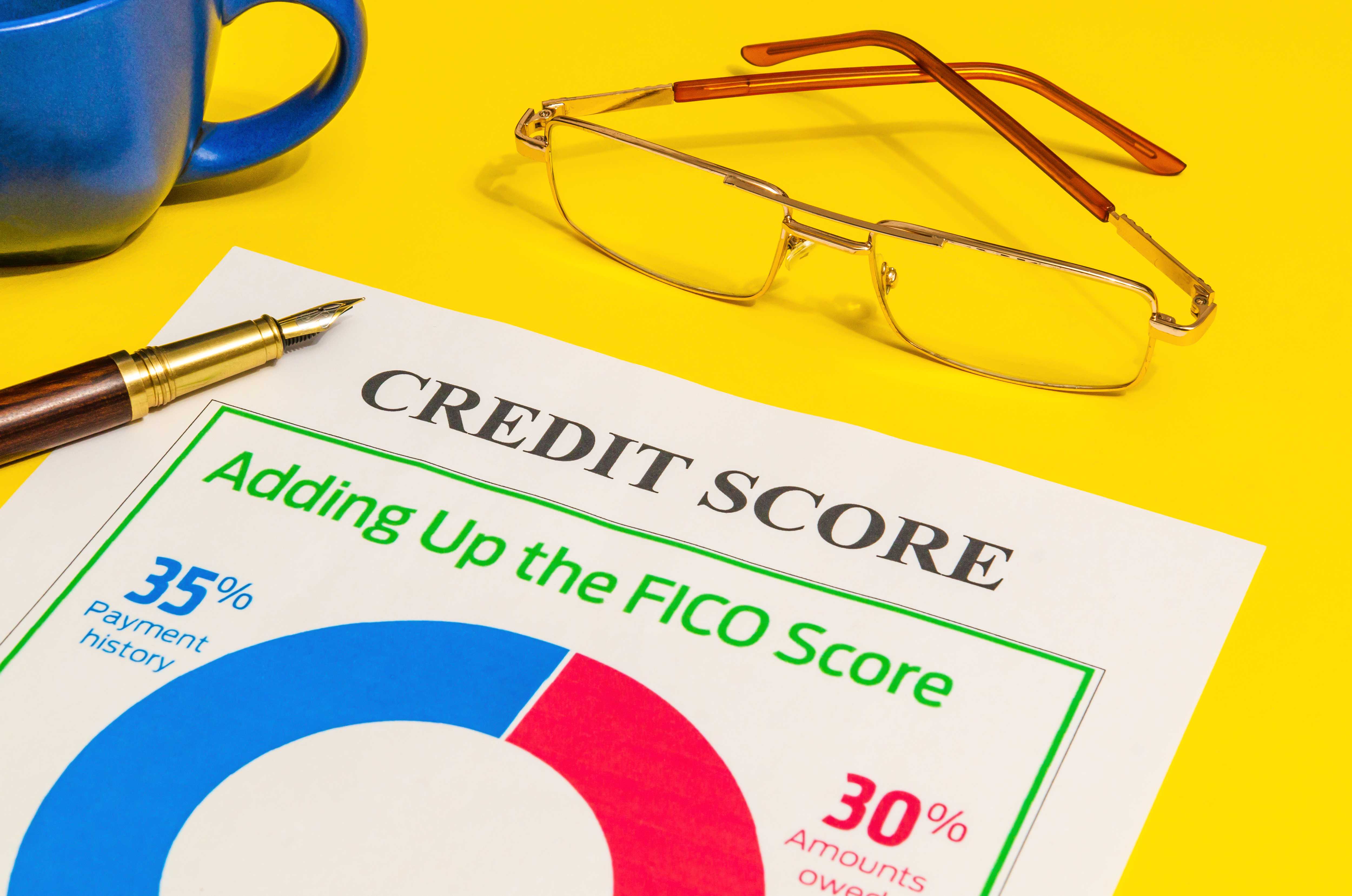

One of the primary benefits of owning a credit card is its ability to help you build and improve your credit score. Responsible use, including making on-time payments and maintaining low credit card balances, can establish a positive credit history and boost your creditworthiness over time.

2. Convenience and Security

Credit cards offer unmatched convenience when making purchases. They eliminate the need to carry large amounts of cash and provide a layer of security with features like purchase protection, fraud alerts, and zero-liability policies that protect you from unauthorized transactions.

3. Rewards and Cashback

Many credit cards offer rewards programs that allow you to earn points, miles, or cashback on your purchases. These rewards can translate into substantial savings or travel benefits when used strategically. Choosing a card that aligns with your spending habits can maximize your rewards.

4. Grace Period and Interest-Free Period

Credit cards come with a grace period, usually around 21 to 25 days, during which you can pay your balance in full without incurring any interest charges. This feature provides a short-term, interest-free loan for your purchases, offering financial flexibility and cost savings when used wisely.

5. Budgeting and Expense Tracking

Credit card statements provide a detailed record of your spending, making it easier to track expenses and create budgets. Some credit card companies even categorize your purchases, helping you analyze your spending habits and make informed financial decisions.

6. Travel Benefits

Certain credit cards offer travel-related perks such as travel insurance, airport lounge access, and rental car insurance. These benefits can enhance your travel experiences while saving you money on travel-related expenses.

7. Purchase Protection and Extended Warranty

Credit cards often come with purchase protection, which covers damaged or stolen items purchased with the card. Additionally, some cards extend the manufacturer's warranty on eligible products, providing added peace of mind.

8. Emergency Funds

In emergencies or unexpected situations, credit cards can serve as a financial lifeline. They offer access to a predetermined credit limit, providing a safety net for unforeseen expenses or emergencies.

9. Rental Car Benefits

When renting a car, many credit cards provide insurance coverage, potentially saving you the cost of purchasing rental car insurance at the counter. This can lead to significant savings, especially for frequent travelers.

10. Special Financing Offers

Credit card companies frequently offer promotional financing deals, including 0% APR introductory periods for purchases or balance transfers. These offers can help you spread out payments or consolidate high-interest debt, saving you money on interest charges.

Conclusion

Credit cards are versatile financial tools that offer a multitude of benefits beyond just being a convenient payment method. When used responsibly, they can help you build credit, earn rewards, enhance security, and provide financial flexibility. From purchase protection to travel perks and special financing offers, credit cards offer valuable advantages that can improve your financial well-being. However, it's crucial to use them wisely, pay bills on time, and avoid excessive debt to maximize these benefits while minimizing potential drawbacks. Understanding the full scope of what credit cards can offer is key to making informed financial decisions and harnessing their potential for your benefit.