Power Rental Market Analysis:

Market Research Future (MRFR) predicts the global Power Rental Market size to reach USD 18.11 billion, from 2021-2028 (forecast period).

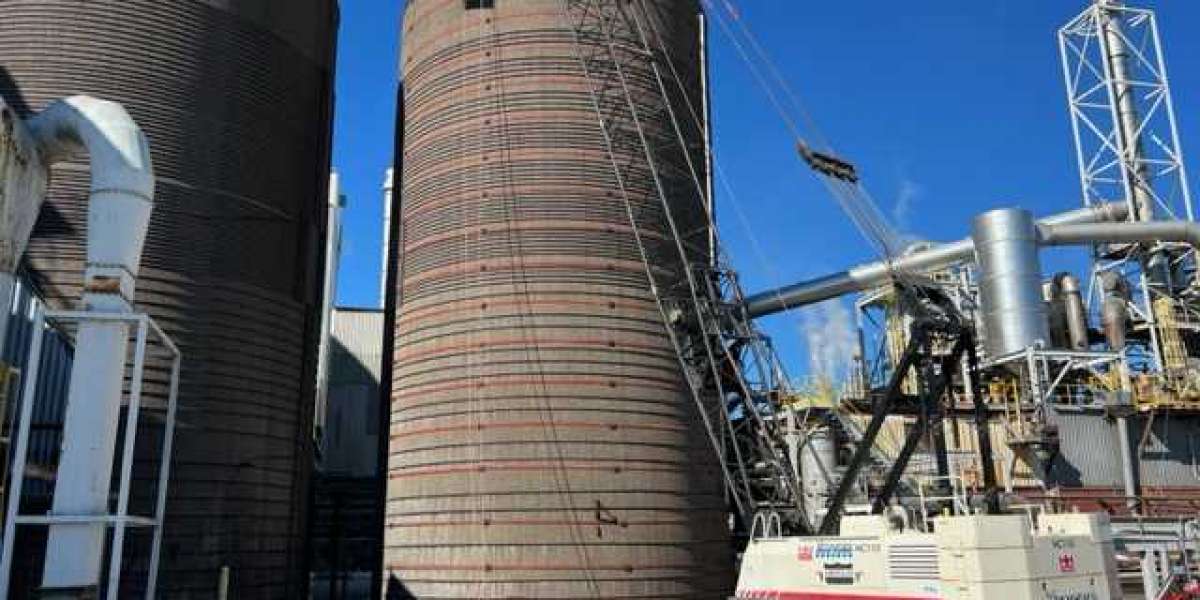

Demand for Uninterrupted Power Supply from Mining and Oil Gas Industries

Mining and oil and gas exploration are usually carried out in isolated locations. Because of the extremely combustible nature of the extracted compounds, human life at such locations is in danger; consequently, sufficient illumination and power are required for such operations. Mining and oil and gas industries in the United States, Australia, and several African countries are predicted to grow significantly as a result of increased investment. In the following years, new mining projects are projected to be established in China, Australia, and India. These elements must be present in order to create demand for power rental solutions. As per the Australian Bureau of Statistics, Australia invested more than USD 2.3 billion on mining exploration in 2019, an almost 19% increase over the previous year.

Request For Sample Report @ https://www.marketresearchfuture.com/sample_request/1226

Moreover, since the introduction of hydraulic fracturing, the United States has remained one of the world's top oil-producing countries. Exxon Mobil intends to invest USD 50 billion in increasing its integrated activities in the United States until 2025. This includes developing new oil and gas wells in the Permian Basin and constructing pipelines to transport output to the Gulf Coast, where the company is increasing its downstream footprint. These factors are predicted to fuel demand for power rental solutions in the future.

COVID-19 Impact on the Worlwide Power Rental Market

The global COVID-19 crisis in the first half of 2020 led several countries to go into quarantine. All non-essential operations have been halted since governments and local authorities set strict instructions. The stoppage of end-user operations had an adverse impact on the power rental sector. Moreover, while end-user sectors continue to operate at less than full capacity, production, and supply chain delays are predicted to provide a short-term challenge to the power rental industry. Several enterprises, Nevertheless, have turned this crisis into an opportunity to provide societal services. Cummins, for instance, has transformed its air filter manufacturing factory into a respirator (filtration material for face masks) manufacturing unit.

Key Players

Notable players in the worldwide power rental market are Cummins, Inc. (U.S.), Aggreko Plc. (U.K.), Caterpillar Inc. (U.S.), United Rentals, Inc. (U.S.), Herc Rentals Inc. (U.S.), Speedy Hire Plc. (U.K.), Bredenoord Exploitatiemij B.V. (The Netherlands), Ashtead Group Plc. (U.K.), APR Energy (U.S.), L.M. Generating Power Co. Ltd. Ltd (Canada), and others.

Market Segmentation

The worldwide power rental industry has been divided into fuel type, application, and end-user.

By fuel type, the worldwide power rental industry has been segmented into diesel, gas, others.

By application, the worldwide power rental industry has been segmented into baseload, stand-by power, and peak shaving.

By end-user, the worldwide power rental industry has been segmented into oil gas, utilities, shipping, manufacturing, mining, construction, and others.

Request Customized Report @ https://www.marketresearchfuture.com/ask_for_customize/1226

Regional Analysis

North America to Dominate the Global Market

The North American area leads the global power rental market. With a market valuation of USD 3.773.9 million, North America had the largest share of 31.60% in 2016. The region's market is expanding as a result of aging grid infrastructure and natural disasters, which generate frequent power outages and increased demand from the industrial sector. Furthermore, rising investment in mining and related exploratory operations in the region supports the need for power rental equipment during the projection period.