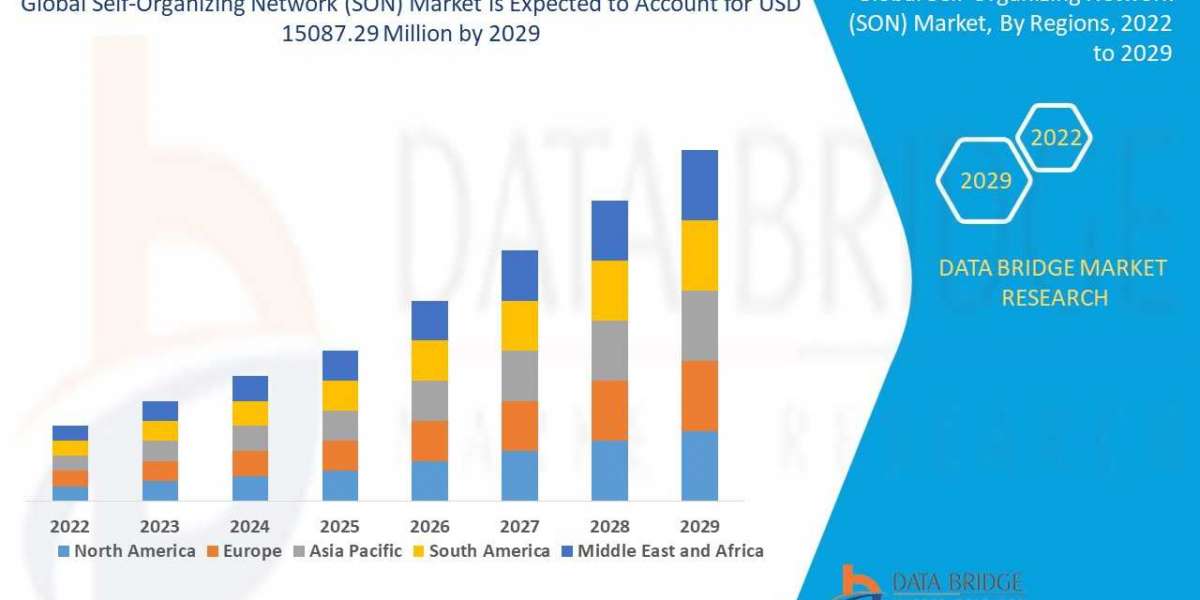

November 2018, by the Boston Consulting Group (BCG) project that with the introduction and penetration of the stack of India (UPI) in the banking system, 50% of loan seekers with internet access tend to buy online loans. In fact, out of the total population, there are around 55% of consumers with digital traces where a 23% retail loan is amazing today. Loan ticket size is influenced digitally, found slightly higher by 4% in the case of SMEs. In short, the report concluded that Indian digital loans were a $ 1 trillion opportunity for the next 5 years! Have a look at the report of revenue generated.

One of the main factors that facilitates such humongous growth is that technology has made it possible to reduce time in loan processing. People no longer need to wait for months to get credit. Reports studied loan models from various companies, and the average time processing application and distributing loans, when everything is done digitally, in just 10 minutes!

With such concrete data, it becomes absolutely necessary that every digital lending company. It all begins by identifying reliable loan management software partners who can understand the nuances of your business, and mingle with your existing operation.

Here are some Mortgage management software filters that whatever you consider your business to be passed -

Personalized with your needs

Even though technology has become sophisticated, one size shoes are not suitable for all. This software must be able to adjust itself to meet the specific requirements of your business operation, and moreover the specific needs of all your consumer segments.

Technology infrastructure that comes

Mortgage management software development must order the least coding skills from your end. It must include a pile of modern technology such as fire gateways, SOA activities, etc. And have cloud-based infrastructure for complete Siber security. Should be able to accommodate futuristic technologies like open bank architecture and update itself without hindering existing operations.

Scope for innovation

It must be able to drive the new product / service in a relaxing environment. There must be a specified structure to introduce and implement new products, services, or processes with minimal efforts and time.

Meet legal compliance.

Software must be legally appropriate at all stages of the loan cycle. Applying appropriate taxes, interest rates, invoice discounts, and other norms as directed by RBI must be automatic.

User friendly for employees consumers

Good mortgage management software with all high-end integration in the back-end, should not be used for use by employees and consumers. User experience and interface that lag free lag and easy to understand is what software must be provided.

Comprehensive Reporting Analysis

This software must be able to meet not only current business requirements. I. Short-term goals, but also helps businesses work on their long-term vision with reporting supported by data and intelligent analysis.

Smart intelligence and automation

Software must spread artificial intelligence to automate most manual tasks at a lower cost. Automation will make the entire loan cycle safe by removing the scope of errors and fraud. AI-backed analysis will help companies understand the prospect of current and future growth.

Ease of delegation

Even though automation will take care of the maximum manual process, you still need people to handle overall management. This software must be able to easily introduce, modify, or change the hierarchy and allow delegates of automatic responsibility freely confused at each stage of the cycle.

Integrated Accounting Machine

Accounting is always a boring affair. However, with improved operating loans, if the software offers automated accounting solutions, and enables seamless integration . Other accounting services that the company might use, it will lead to a transparent and error-free accounting process.

Set the specified rules before

This software must offer scope to implement automatic rules for the product, service, and stages of the loan cycle through a rule machine that will lead to a risk-free efficient workflow without the need to monitor operations.

Automate debt recovery and collection

Although debt recovery and collection are the end of the loan cycle, it involves various sub-processes itself which can be fully automated. From sending personalized reminders to customers about the due date for geographical locations to receive digital payments, fundraising software and increasing receipts, all must be automated and regulated by mortgage management software.

Reliable customer service

Even with all the advantages, the software system might face problems and you may need help with it. Mortgage management Software companies must have skilled customer service and be able to quickly respond to your questions and solve them.

Now when you start looking for reliable mortgage management software partners, we hope this passes all the filters we screen. By the way, we offer a complete comprehensive loan solution and even EDI software development that provides all the features above and more.